Me-Gold by Motilal Oswal :

Shines Brighter

With 999.9 purity, get fineness online gold in India

Safety, at no extra cost

Your Gold is vaulted in a 100% insured facility by MMTC PAMP, for free

Buy 0.5 gms, we don't judge

Buy as low as 1,000 or 0.5 gms, whenever & wherever

Buy in fractions, accumulate for future

Buy via our GSP and fulfil your dreams with every installment

What makes Me-Gold better?

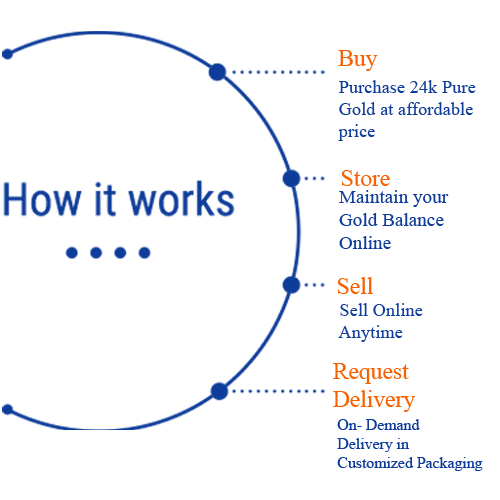

100% online

with zero paperwork in just 3 clicks

Buy, Store and Sell

it Anytime, Anywhere

Convert

into physical form and get it delivered, safely and easily

Gold ETF

Gold ETF

Gold Exchange Traded Funds (ETFs) are simple investment products that combine the flexibility of stock investment and the simplicity of gold investments. ETFs trade on the cash market of the National Stock Exchange, like any other company stock, and can be bought and sold continuously at market prices.

Gold ETFs are passive investment instruments that are based on gold prices and invest in gold bullion. Because of its direct gold pricing, there is a complete transparency on the holdings of an ETF. Further due to its unique structure and creation mechanism, the ETFs have much lower expenses as compared to physical gold investments.

| Issuer | Name | Symbol | Underlying | Launch Date |

|---|---|---|---|---|

| Axis Mutual Fund | Axis Gold ETF | AXISGOLD | Gold | Nov 2010 |

| Birla Sun Life Mutual Fund | Birla Sun Life Gold ETF | BSLGOLDETF | Gold | May 2011 |

| Canara Robeco MF | Canara Robeco Gold ETF | CANGOLD | Gold | Mar 2012 |

| HDFC Mutual Fund | HDFC Gold Exchange Traded Fund | HDFCMFGETF | Gold | Aug 2010 |

| ICICI Prudential Mutual Fund | ICICI Prudential Gold Exchange Traded Fund | IPGETF | Gold | Aug 2010 |

| IDBI AMC | IDBI Gold ETF | IDBIGOLD | Gold | Nov 2011 |

| Kotak Mutal Fund | Kotak Gold Exchange Traded Fund | KOTAKGOLD | Gold | Jul 2007 |

| Quantum Mutual Fund | Quantum Gold Fund (an ETF) | QGOLDHALF | Gold | Feb 2008 |

| Reliance Mutual Fund | Reliance Gold Exchange Traded Fund | RELGOLD | Gold | Nov 2007 |

| Religare Mutual Fund | Religare Gold Exchange Traded Fund | RELIGAREGO | Gold | Mar 2010 |

| SBI Mutual Fund | SBI Gold Exchange Traded Scheme | SBIGETS | Gold | Apr 2009 |

| UTI Mutual Fund | UTI GOLD Exchange Traded Fund | GOLDSHARE | Gold | Mar 2007 |

| Reliance Nippon Life Asset Management Limited | Reliance ETF Nifty BeES | NIFTYBEES | NIFTY 50 Index | Dec 01 |

| Reliance Nippon Life Asset Management Limited | Reliance ETF Nifty 100 | RELCNX100 | NIFTY 100 | Mar 13 |

| Reliance Nippon Life Asset Management Limited | Reliance ETF Bank BeES | BANKBEES | NIFTY Bank | May 04 |

| Reliance Nippon Life Asset Management Limited | CPSE ETF | CPSEETF | NIFTY CPSE Index | Mar 14 |

| Reliance Nippon Life Asset Management Limited | Reliance ETF Dividend Opportunities | RELDIVOPP | NIFTY Dividend Opportunities 50 | Apr 14 |

| Reliance Nippon Life Asset Management Limited | Reliance ETF Consumption | RELCONS | NIFTY India Consumption | Apr 14 |

| Reliance Nippon Life Asset Management Limited | Reliance ETF Infra BeES | INFRABEES | NIFTY Infrastructure | Sep 10 |

| Reliance Nippon Life Asset Management Limited | Reliance ETF Junior BeES | JUNIORBEES | NIFTY Next 50 | Feb 03 |

| Reliance Nippon Life Asset Management Limited | Reliance ETF PSU Bank BeES | PSUBNKBEES | NIFTY PSU BANK | Oct 07 |

| Reliance Nippon Life Asset Management Limited | Reliance ETF Shariah BeES | SHARIABEES | NIFTY50 Shariah Index | Mar 09 |

| Reliance Nippon Life Asset Management Limited | Reliance ETF NV20 | RELNV20 | NIFTY50 Value 20 Index | Jun 15 |

| Reliance Nippon Life Asset Management Limited | Reliance ETF Hang Seng BeES | HNGSNGBEES | HangSeng | Mar 10 |

| Reliance Nippon Life Asset Management Limited | Reliance ETF Liquid BeES | LIQUIDBEES | NIFTY 1 D rate Index | Jul 03 |

| Reliance Nippon Life Asset Management Limited | Reliance ETF Long Term Gilt | RRSLGETF | NIFTY 4-8 yr G-Sec Index | Jul 16 |

| Reliance Nippon Life Asset Management Limited | Reliance ETF Gold BeES | GOLDBEES | Gold | Mar 07 |

Sovereign Gold Bond (SGB)

Investing in gold is much more easy and convenient now. With the Government of India's Sovereign Gold Bonds Scheme you can earn an assured interest rate eliminating risk and cost of storage.

Sovereign Gold Bond Benefits

Hassle free: Ownership of gold without any physical possession (No risks and no cost of storage)

Tax treatment: The capital gains tax arising on redemption of SGB to an individual has been exempted. The indexation benefits will be provided to long term capital gains arising to any person on transfer of bond.

Tradability: Bonds will be tradable on stock exchanges within a fortnight of the issuance on a date as notified by the RBI.

Transferability: Bonds shall be transferable by execution of an Instrument of transfer in accordance with the provisions of the Government Securities Act.

Sovereign Gold Bond Features

Eligibility: The bonds will be restricted for sale to resident Indian entities including individuals, HUFs, Trusts, Universities and Charitable institutions. For online application through ICICI Bank, the bonds are for sale to only ‘individuals’ through the Internet Banking Channel and iMobile App. Customers falling into other category of investors may however approach the branch and fill-up the application form to apply for the tranche.

Denomination: The bonds will be denominated in units of one gram of gold and multiples thereof.

Minimum size: Minimum permissible investment will be 1 gram of gold.

Maximum limit: Maximum limit of subscription shall be of 4 kg for individuals, 4 kg for Hindu Undivided Family (HUF) and 20 kg for trusts and similar entities notified by the government from time to time

Interest rate: The investors will be paid Interest on the amount of initial investment at the rate notified by RBI for a particular tranche at the time of its launch and is payable semi-annually.

Tenor: The tenor of the bond will be for a period of 8 years with an exit option from 5th year onwards to be exercised on the interest payment dates.

Redemption: Redemption price shall be fixed in Indian Rupees and the redemption price shall be based on simple average of closing price of gold of 999 purity of previous 3 business days from the date of repayment, published by the India Bullion and Jewelers Association Limited.

*May change from issue to issue