Fixed Deposits

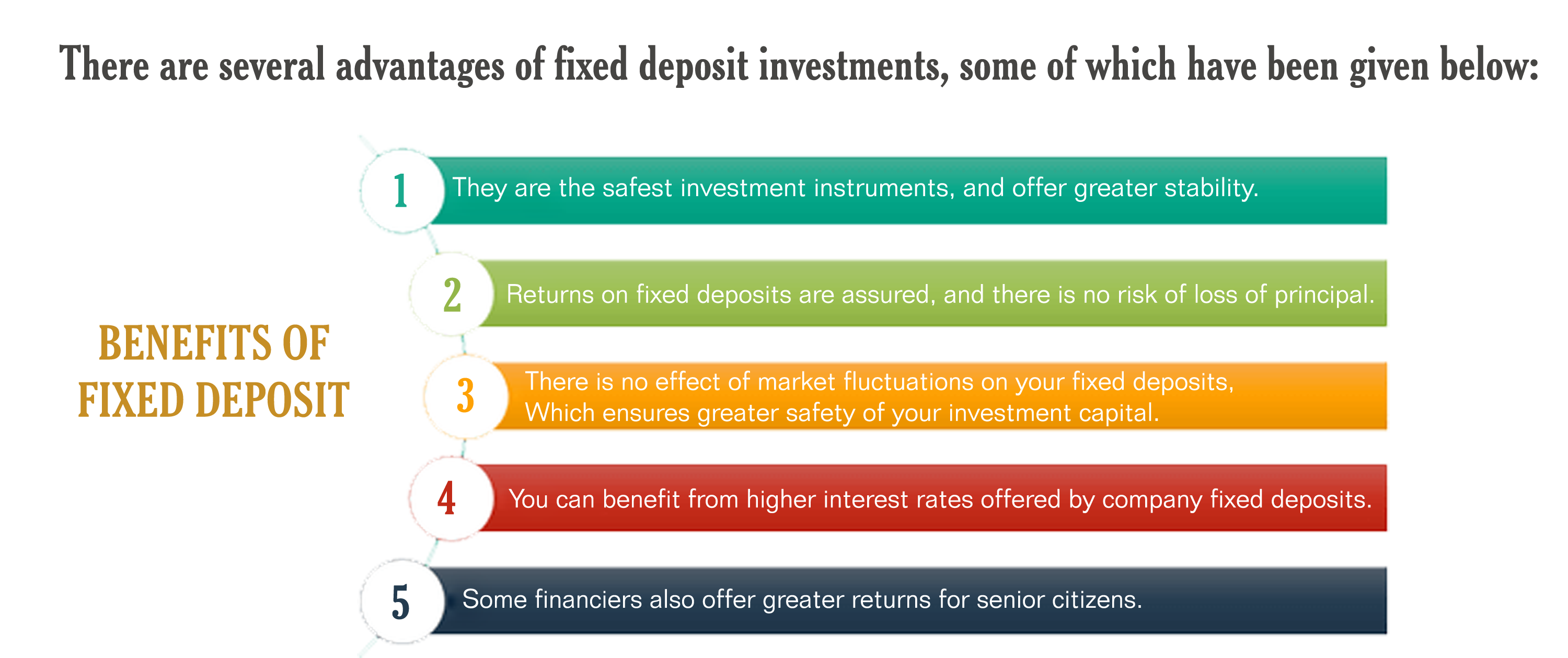

Fixed Deposits (FD) are investment instruments offered by banks and non-banking financial companies, where you can deposit money for a higher rate of interest than savings accounts. You can deposit a lump sum of money in fixed deposits for a specific period, ranging from 7 days to 10 years.

Once the money is invested with a reliable financier, it starts earning an interest based on the duration of the deposit. Usually, the defining criteria for fixed deposits are that the money cannot be withdrawn before maturity, but you may withdraw them after paying a penalty.

Corporate Bonds

Corporate bonds are debt instruments.These are issued by the corporate companies for a specified period.

Debt products are low risk and reasonably safe and consistent investment options. It 's a preferred option for investors seeking fixed regular income with liquidity

- Wide range of products from Company Fixed Deposits, Bonds, NCDs etc.

- Flexibility to choose your investment amount, tenure, interest payment and maturity periods.

- Dedicated Research and Advisory desk for customized recommendations

- Online Tracking feature to help you get all your financial investments under one roof.

- Regular updates via email on new products and recommendations.