India Business Excellence Fund by Motilal Oswal

- Motilal Oswal Financial Services Limited (‘MOFSL’) is an equity investment house and diversified financial services company founded in 1987

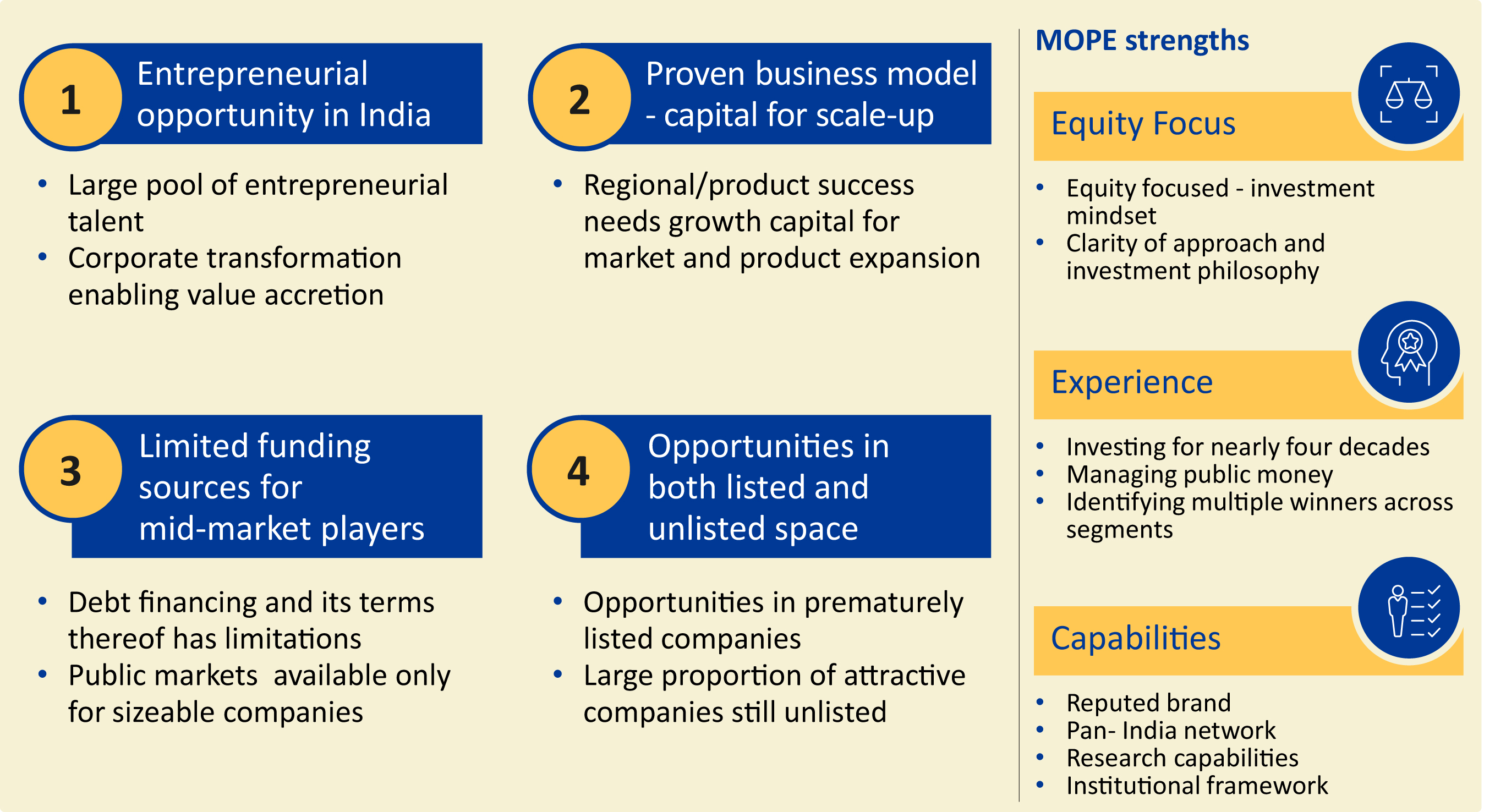

- MOPE, subsidiary of MOFSL, has focused on mid-market investing in India since 2006

- Currently manages and/or advises two growth capital India funds and three real estate India funds with a cumulative AUM of over INR 3,500 crores Investment Strategy

- Investment in mid-market enterprises1 that are typically market leaders2 which are generally managed by first-generation entrepreneurs

- An extensive network of 300+ intermediaries ensuring sourcing of numerous transactions and investing in the right ones.

IBEF PRINCIPLES

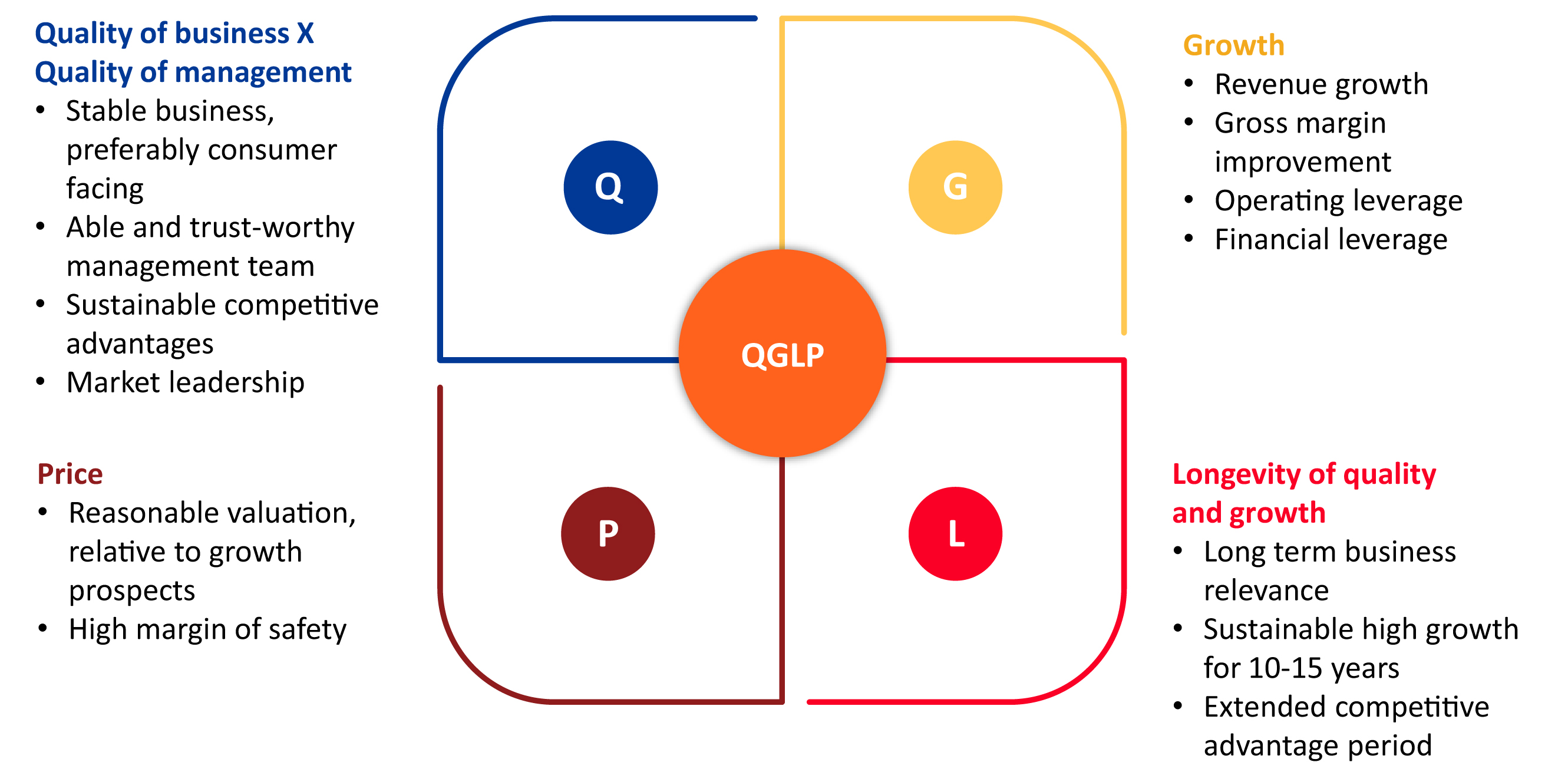

The Team will continuously evaluate target companies in these sectors to ensure that they fit in the QGLP framework. Given the expected holding period of four to five years, the Fund will invest in industries where there is potential during the investment period for significant growth and where sizeable investments are contemplated. The potential for interest in the industry from larger established business groups and multinationals is also carefully evaluated to determine the potential for consolidation in the industry in the next few years.

CORE PRINCIPLES

What we look for in companies before investing is only an extension of our own value system. Therefore, what follows are the essential principles that guide our own organisation and investment strategy.

1. Entrepreneurship

MOPE strives to partner with entrepreneurial talents across sectors. We look for highly passionate, visionary, tenacious and committed entrepreneurs who have built excellent businesses. We consider ourselves as a fund for entrepreneurs by entrepreneurs.

2. Business Excellence

MOPE looks for businesses that have traits of excellence, have leadership potential, ability to scale up and are of high quality. We believe that management foresight, tenacity and quality of business operations, not intermittently but consistently form the foundations of business excellence. We endeavor to partner with excellent management teams and work with them to further enhance their companies.

3. Transparency and integrity

We continue to be guided by our core values of integrity and transparency in our investment process. We also maintain these values in the investments we make. We look for businesses and management teams with high level of transparency and integrity.

INVESTMENT APPROACH

Motilal Oswal Private Equity Advisors Private Limited has developed its investment strategy by taking into consideration the structural shift in the Indian

economy to a $4- $5 tn economy in next five years resulting in significant opportunities for various sectors.

Investments in Mid-Market Enterprises

Mid-market enterprises are the growth engines of the economy filling crucial gaps in various industries and geographies. Vast majority of them are family owned and operate on the strength of their local knowledge. Many of these mid-market enterprises aim to transform into a large institutionalized organization. However, this is restricted by ease of access to capital, talent and mentorship.

Focus on Growth Capital

MOTILAL OSWAL PRIVATE EQUITY ADVISORS PRIVATE LIMITED prefers to enter as a substantial minority shareholder in companies exhibiting superior growth. Growth capital minority investments allow MOTILAL OSWAL PRIVATE EQUITY ADVISORS PRIVATE LIMITED to add value to business.

Preferred Sectors

The four primary target industry clusters are:.

- CONSUMER

- FINANCIAL SERVICES

- HEALTHCARE

- INDUSTRIAL

- Min Investment : 2.5 cr

- Kind of investor : Investor who like to invest with a long term wealth creation view

- Duration of investment : 5-7 YEARS